This short article provides the business analyst an analogy on how process owners manage value chains by monitoring leading and lagging metrics. The article highlights the need for business analysts to provide process owners with these metrics. These metrics provide indications of positive and negative process and business risks. Examples of the traditional risk response types of accept, avoid, mitigate, transfer, exploit, enhance, and share are provided.

This short article provides the business analyst an analogy on how process owners manage value chains by monitoring leading and lagging metrics. The article highlights the need for business analysts to provide process owners with these metrics. These metrics provide indications of positive and negative process and business risks. Examples of the traditional risk response types of accept, avoid, mitigate, transfer, exploit, enhance, and share are provided.

The article starts with a sport’s discussion. In this case, familiarity with the game of baseball is needed. Note the following analogy:

-

Baseball team manager – Process owner

-

Game (nine or more innings) – Process (value chain)

-

Game situations – Process and business risk events

-

Changes in game strategy – Risk responses

-

Game statistics and inning box score – Leading metrics

-

Final box score – Lagging metric

Baseball

|

America’s past-time is a true management game. Unlike soccer where the game is totally decided by the players on the pitch, it’s the baseball team managers that control the game by giving signals to players on what action to take on the diamond. For example, team managers may direct players to take a pitch at bat, steal or holdup at a base). But what makes baseball a true management game is that team managers are allowed to actually put the game on pause (time-out) and adjust their game strategy. America’s past-time is a true management game. Unlike soccer where the game is totally decided by the players on the pitch, it’s the baseball team managers that control the game by giving signals to players on what action to take on the diamond. For example, team managers may direct players to take a pitch at bat, steal or holdup at a base). But what makes baseball a true management game is that team managers are allowed to actually put the game on pause (time-out) and adjust their game strategy.

|

Game Strategy

When baseball team managers feel their win is either at risk or can be assured, they call “time” to the umpire. During this stoppage, the team managers are allowed to change their game strategy based on the game situation, game statistics (e.g., batting records, base runner speed, and pitches thrown) and/or the inning box score. For instance:

Note that the team manager can just accept a game situation and do nothing.

Business Process

|

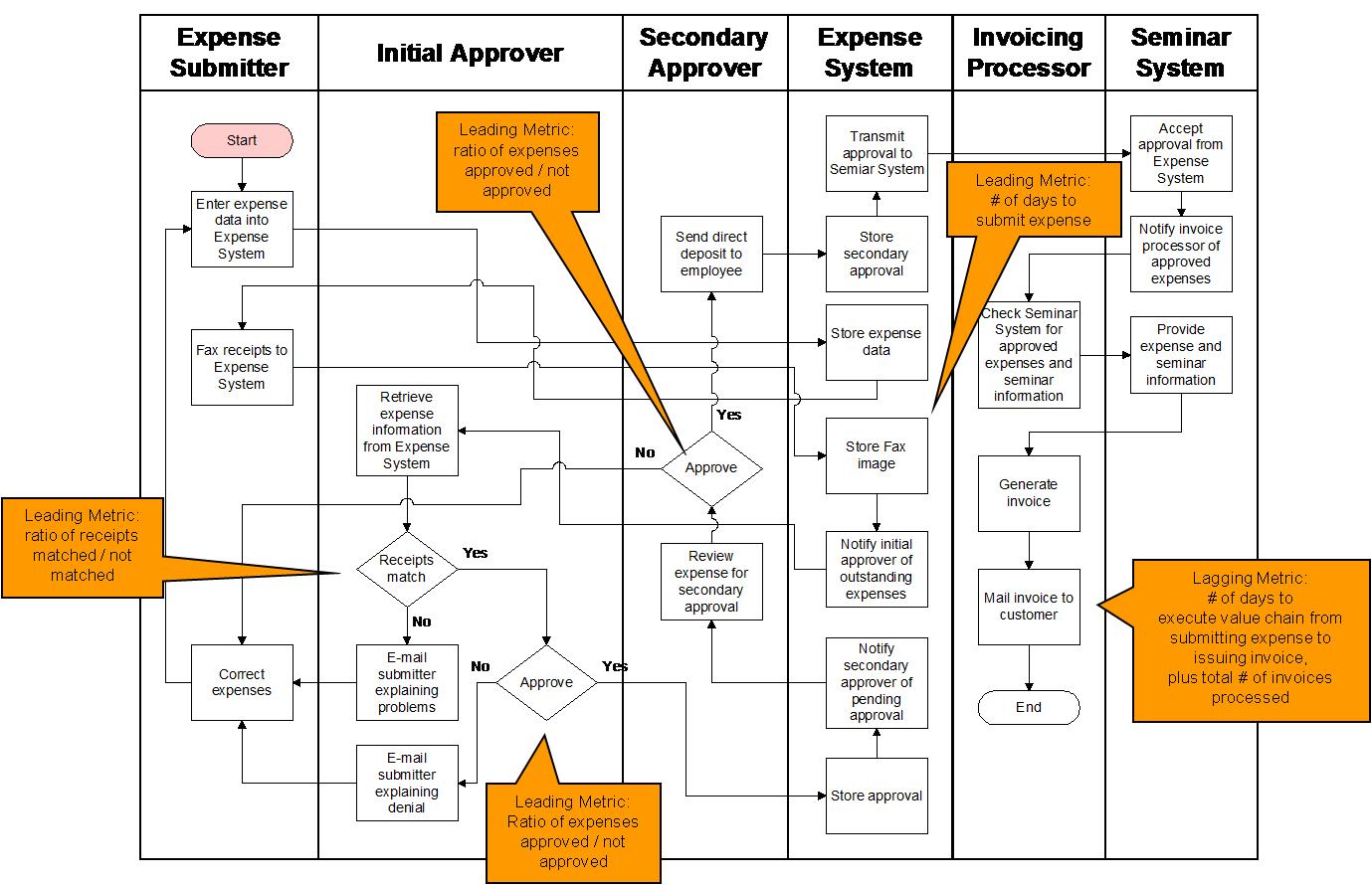

In business, the game is a process and the team manager is the process owner. Game situations are equivalent to the constantly changing risk events that happen within a process and in a business. And the game statistics, inning box score and final box score are the associated leading metrics and lagging metric of the process respectively. Leading metrics are taken at critical points within a process and lagging metrics are at the end of a process – the end business goal. In business, the game is a process and the team manager is the process owner. Game situations are equivalent to the constantly changing risk events that happen within a process and in a business. And the game statistics, inning box score and final box score are the associated leading metrics and lagging metric of the process respectively. Leading metrics are taken at critical points within a process and lagging metrics are at the end of a process – the end business goal.

|

|

Business Analysts need to provide process owners leading metrics that indicate if the lagging metric is achievable.

|

Figure 1. Process Example showing Leading and Lagging Metrics

Process Strategy

Process owners monitor process and business risk events. Process leading metrics have an expected value range set by the process owner. When they indicate a significant deviation outside that range, it indicates a negative process risk. The leading metric deviation points to where the problem exists and that there is a threat in accomplishing the lagging metric goal. Process owners then analyze the cause of the deviation and determine the appropriate risk response. At the same time, the business may present positive risks or opportunities. For instance:

Note that the process owner can just accept a process and/or business situations and do nothing as a risk response.

|

Business Analysts need to ensure that process owners can monitor process and business risk events.

|

Summary

Just like baseball team managers monitor game situations, process owners monitor process and business risk events. Specific to the process, they use leading metrics to determine if process adjustments are needed in order to continually achieve the lagging metric. Each leading metric has an expected value range. So long as the leading metric is within the range, process owners can remain confident that the lagging metric goal is achievable. Note that the lagging metric by its nature cannot alert the process owners to risk. The lagging metric is at the end of the process (value chain). Essentially it’s history – the game is over. Just like baseball team managers monitor game situations, process owners monitor process and business risk events. Specific to the process, they use leading metrics to determine if process adjustments are needed in order to continually achieve the lagging metric. Each leading metric has an expected value range. So long as the leading metric is within the range, process owners can remain confident that the lagging metric goal is achievable. Note that the lagging metric by its nature cannot alert the process owners to risk. The lagging metric is at the end of the process (value chain). Essentially it’s history – the game is over. |

Author: Besides having coached soccer and baseball, Mr. Monteleone holds a B.S. in physics and an M.S. in computing science from Texas A&M University. He is certified as a Project Management Professional (PMP®) by the Project Management Institute (PMI®), a Certified Business Analysis Professional (CBAP®) by the International Institute of Business Analysis (IIBA®), a Certified ScrumMaster (CSMTM) and Certified Scrum Product Owner (CSPOTM) by the Scrum Alliance, and certified in BPMN by BPMessentials. He holds an Advanced Master’s Certificate in Project Management (GWCPM®) and a Business Analyst Certification (GWCBA®) from George Washington University School of Business. Mark is the President of Monteleone Consulting, LLC and can be contacted via e-mail – [email protected].

Author: Besides having coached soccer and baseball, Mr. Monteleone holds a B.S. in physics and an M.S. in computing science from Texas A&M University. He is certified as a Project Management Professional (PMP®) by the Project Management Institute (PMI®), a Certified Business Analysis Professional (CBAP®) by the International Institute of Business Analysis (IIBA®), a Certified ScrumMaster (CSMTM) and Certified Scrum Product Owner (CSPOTM) by the Scrum Alliance, and certified in BPMN by BPMessentials. He holds an Advanced Master’s Certificate in Project Management (GWCPM®) and a Business Analyst Certification (GWCBA®) from George Washington University School of Business. Mark is the President of Monteleone Consulting, LLC and can be contacted via e-mail – [email protected].