ANSWER

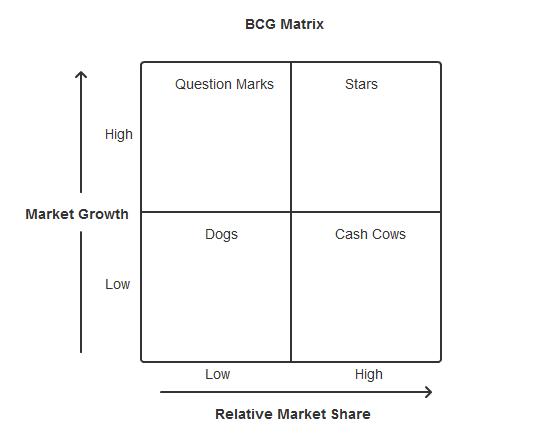

The BCG Matrix was developed by the Boston Consulting Group in 1986 in order to evaluate and analyze the business units and product offerings of corporations. Companies can use this simple 2 x 2 matrix as an analytical tool in portfolio analysis, strategic management, product management, and brand marketing.

The BCG Matrix plots business units or product offerings along two axis; the first is market growth, the second is market share.

Market growth describes the maturity of a market. New markets continue to growth and expand over time, presenting additional opportunities for revenue that can be shared among market participants. Eventually, all markets mature and as they new revenues sources diminish.

Market share describes the percentage of the overall market that a company’s business unit or product offerings enjoy.

A business unit or product line is categorized based on the quadrant of the matrix in which it resides. These categories are Cash Cows, Stars, Question Marks, and Dogs.

Cash Cows represent business units or product lines (businesses more generically) that enjoy a large market share within a market which is experiencing low market growth. This means that the market has already matured, and that the business is well established and positioned within the market. Cash Cows typically generate cash in excess of the amount needed to maintain the business. These steady businesses are like having your own money mint. It’s ever company’s goal to have as many of these as possible. Little capital investment is turned into the businesses since it would be wasted on such a mature market (nothing more could be gained).

Stars (or Rising Stars) are businesses that enjoy a large market share in a fast growing market. Like Cash Cows they boast a prominent market position for the time, but they required investment of resources to maintain or increase their market share is the market continues to grow. They goal of any business is to manage and nurture their Stars through the market growth maintaining their market position. As the market matures, those businesses that maintain their market position with turn from Stars into Cash Cows requiring little to no capital investment while continuing to throw off large sums of money.

Question Marks are businesses that have a low market share in a fast growing market. If Stars have a goal of becoming Cash Cows, Question Marks have a goal of first becoming starts. Since the market growth is strong, there is potential for Question Marks. But their current market share is low. They often require large amounts of capital to gain in market share, yet there are no guarantees that they will succeed. Questions Marks ultimately have a fate of becoming Stars if they successfully gain market share, or they will never gain market share and become Dogs. All the while, they are taking large amounts of capital to sustain. Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

Dogs are businesses that have a low market share in a slow growing, mature market. Sometimes they are pet projects with small amounts of capital allocated to support them. In the best circumstances they barely make enough to sustain themselves. Clearly Dogs are the bleakest of situations. Of course, there may be times when a Dog makes sense to keep around. Maybe the breakeven business creates synergies with other lines of business thus providing an intangible benefit. Other times, there may be other social benefits to such business due to the people they employ and the opportunities they create within the environment in which they operate. The more mature the market the more difficult it would be for a Dog to ever become anything other than a Dog as growth is always more difficult in mature markets.

--

Chris Adams

LinkedIn Profile